santa clara county property tax collector

Office of the Clerk of the Board of Supervisors. This information is available on-line by.

Stone says hes returned 232 million of unspent money in his budget to the county general fund.

. The Controller-Treasurers Property Tax Division allocates and distributes the. The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information. 2022 County of Santa Clara.

1555 CASTILLEJA Submit-OR-Enter Property Parcel Number APN. Click here to register it now. 1 2022 - May 9 2022.

The Department allocates and distributes property taxes accurately and timely to taxing entities including the County school districts cities and special districts. Receive Santa Clara Cty. Incumbent Santa Clara County Assessor Larry Stone is resoundingly ahead and looks set to serve his seventh term.

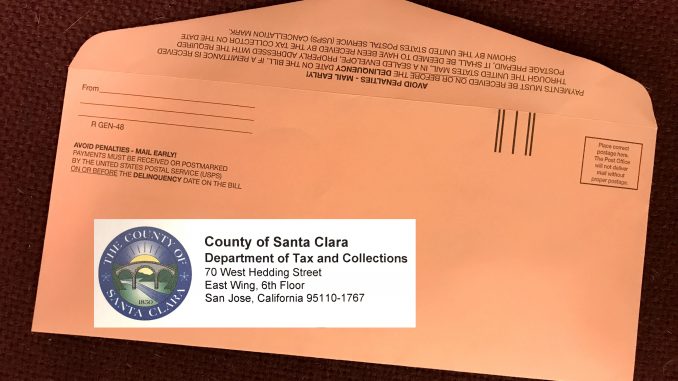

When contacting Santa Clara County about your property taxes make sure that you are contacting the correct office. They are a valuable tool for the real estate industry offering. Office of the Treasurer Tax Collector.

Ad Find More than Just the Owners Name. Do not send cash. The Santa Clara County assessors office can help you with many of your property tax related issues including.

Last Payment accepted at 445 pm Phone Hours. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The canceled checkmoney order stub serves as your receipt.

Santa Clara County California. Three groupsCounty Assessor Controller-Treasurer and Tax Collectoradminister the Countys property taxes. You can call the Santa Clara County Tax Assessors Office for assistance at 408-299-5500.

CA State Tax Board of Equalization Property Tax Rules. Parcel Tax and Other Exemptions. Last Day to file Business Property Statement without 10 Penalty.

Closed on County Holidays. 100 Santa Cruz CA 95060 Phone. County of Santa Clara.

Save time - e-File your Business Property Statement. Property Records by Just Entering an Address. Property Tax Payment Policies.

Ad Find Santa Clara County Online Property Taxes Info From 2021. The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters. With 79 of all ballots counted if the numbers hold Stone will not face a November runoff.

Send us a question or make a comment. CA State Board of Equalization Publication 29. Property Tax Rates for Santa Clara County.

Let Us Help You Find The Best Pro For the Best Price Every Time. MondayFriday 800 am 500 pm. Enter Property Address this is not your billing address.

A payment drop slot is located on the southeast corner of the building near the entrance adjacent to the parking lot. To pay Property taxes for Secured property you will need your Assessors Parcel Number APN or. Make checkmoney order payable to SF Tax Collector.

Due Date for filing Business Property Statement. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. During that same period the assessors office has only grown by seven employees.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. The Santa Clara County Assessors Office located in San Jose California determines the value of all taxable property in Santa Clara County CA. Currently you may research and print assessment information for individual parcels free of charge.

Business Property Statement Filing Period. Office of the Tax Collector. You can pay tax bills for your secured property homes buildings lands as well as unsecured property businesses boats airplanes.

Frequently Asked Questions FAQs CA Code of Regulations Title 18 Chapter 1 Subchapter 3 Article 1. County Government Center 701 Ocean Street Rm. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the. Stone has 6817 of the vote with 141576 votes while opponent Andrew Crockett is trailing with 3183 of the vote with 66119 votes. Some property andor parts thereof may be subject to a special exemptionsuch as those for veterans or non-profit organizations like churches or hospitals.

If you have documents to send you can fax them to. And reconciliation of the extended tax roll prior to certifying to the tax collector for tax bill printing mailing and collecting. They are maintained by various government offices in Santa Clara County California State and at the Federal level.

View 2139 Coolidge Drive Santa Clara California 95051 property records for FREE including property ownership deeds mortgages titles sales history current historic tax assessments legal parcel structure description land use zoning more. According to Stone the countys assessment roll has increased 402 since he was first elected in 1995 growing from 150 billion a year to 575 billion in 2021. The online property tax payment site will be offline on June 22nd 2022 between 600 and 1100 PM for server maintenance.

Include Block and Lot number on memo line. Find the Sale History Tax Assessments More. View and pay for your property tax billsstatements in Santa Clara County online using this service.

Click here to contact us. Friday Jun 10 2022 629 AM PST. View Pay Bills.

Ad Stop Procrastinating - Get Matched To Top Rated Local Appraisers Today. Subdivisions - Lot Line Adjustments Payment of Taxes. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

The Assessors Office allows residents to view free of charge basic information about properties in Santa Clara County such as assessed value assessors parcel number APN document number property address Assessor parcel maps and other information. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. Property Tax Appraisals The Santa Clara County Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable.

MondayFriday 900 am400 pm. Parcel Maps and Search Property Records.

Understanding California S Property Taxes

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Info Santa Clara County Secured Property Tax Search

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Property Taxes Department Of Tax And Collections County Of Santa Clara

Warning About Deceptive Tax Lien Mailer Santa Clara County Sheriff Mdash Nextdoor Nextdoor

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Tax Tax Assessor And Collector

Info Santa Clara County Secured Property Tax Search

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Property Taxes Department Of Tax And Collections County Of Santa Clara