stock sell off end of year

The values calculated above imply SOFI stock could be worth 30 more or 943 per share ie 723 x. How the Rule Works Under this rule if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period before or after the sale date the loss cant be claimed for tax.

/dotdash_Final_Cyclical_vs_Non-Cyclical_Stocks_Whats_the_Difference_Nov_2020-012-2b96cee86d4a4aa994415b25164a24f8.jpg)

Understanding Cyclical Vs Non Cyclical Stocks What S The Difference

The system differs in the US and based on information from the.

:max_bytes(150000):strip_icc()/dotdash_INV-final-Stock-Market-Crash-July-2021-01-88a96c7bec2846dd9986a5777c089417.jpg)

. Analysts generally attribute this rally. Based on broad industry benchmarks like the CAPE ratio the market reached critical mass in 2021. Institutional Investors want to show in their end of year holdings they are picking winners so they tend to sell losers and accumulate stocks that performed well during the year.

11 rows Opinion. Stocks purchased or sold after this date will be settled in 2022 so any capital gains or losses will apply to the 2022 tax year. What to Do With SOFI Stock.

I believe the stock price has fallen faster than the anticipated lower median target price making Boeing a prime stock to add to. Think about it in dollar terms. Yesterday the markets exploded higher as buy the dip came back in force.

Even the laggard the Nasdaq tacked on nearly 1. The Nasdaq Composite tumbled 133 in April. You may therefore want to get.

This year-end stock-selling strategy offsets capital gains taxes and sidesteps the. Before you hit the sell button think it over carefully. Other retailers took a hit on the back of Targets quarterly earnings miss with the SPDR SP Retail ETF falling 84.

The end of year sell off is to sell of stocks that people have lost money on. These include Q1 2018 Q3 2019 and the 2020 COVID-19 sell-off. As I write Friday at noon stocks.

Frustrated investors got no relief in April as US. The end of year sell off is to sell of stocks that people have lost money on. A stock that declines 50 must increase 100 to return to its original amount.

Amazons stock price dropped 72 and. It was no different when sentiment on the US technology exchange turned negative early this year prompting a sell-off. Stock markets fell deeper into the red.

Micro-cap stocks are among the worst performers this year which makes them a good place to hunt for tax-loss-selling bargains. If youre planning to sell assets at a loss to offset gains that have been realized during the year its important to be aware of the wash sale rule. Investors normally dont sell winners at this time to avoid paying taxes on capital gains for the next tax period also tend to sell losers to claim capital loses against their tax bill.

And investors have turned bearish on the markets ability to fulfill such lofty valuations. The second opportunity to profit traces to the tendency of stocks sold in December to bounce back in the New Year. We can see it happens almost every year with 92 of the years.

There are losing stocks out there. Things get more complicated if youre waiting for a short sale transaction to settle. If that kind of lineup features the sort of stocks youd want in your portfolio the Invesco QQQ.

To begin with understand that sell-offs and corrections ie declines of at least 10 from a recent high happen with more frequency than you probably realize. Its still a good company and undervalued but for the foreseeable future this tax year its price isnt going up. A stock that drops 50 from 10 to 5 5 10 50 must rise by 5 or 100 5.

The January Effect is a perceived seasonal increase in stock prices during the month of January. One of the prevailing theories behind the stock market sell-off in 2022 is simply a correction. The Dow ended the day up 18.

In contrast to a 30 gain for the SP 500 this year a 24 rise for. The last day to sell stocks for a tax loss in 2020 is probably December 28 or 29 if your broker will settle the transaction before December 31. Are you thinking about bailing out of stocks before year-end while the capital gains rate is low.

Relative valuation of companies has reached unsustainable levels. First the transaction must settle by December 31st to apply for the 2020 calendar year. For example if you bought SHOP before the Citron story and held youd be selling that off in this instance.

/TheImpactofRecessionsonInvestors2-d2388f716d944e9898e617e7dfd5beaf.png)

How Do Recessions Impact Investors

Best Time S Of Day Week And Month To Trade Stocks

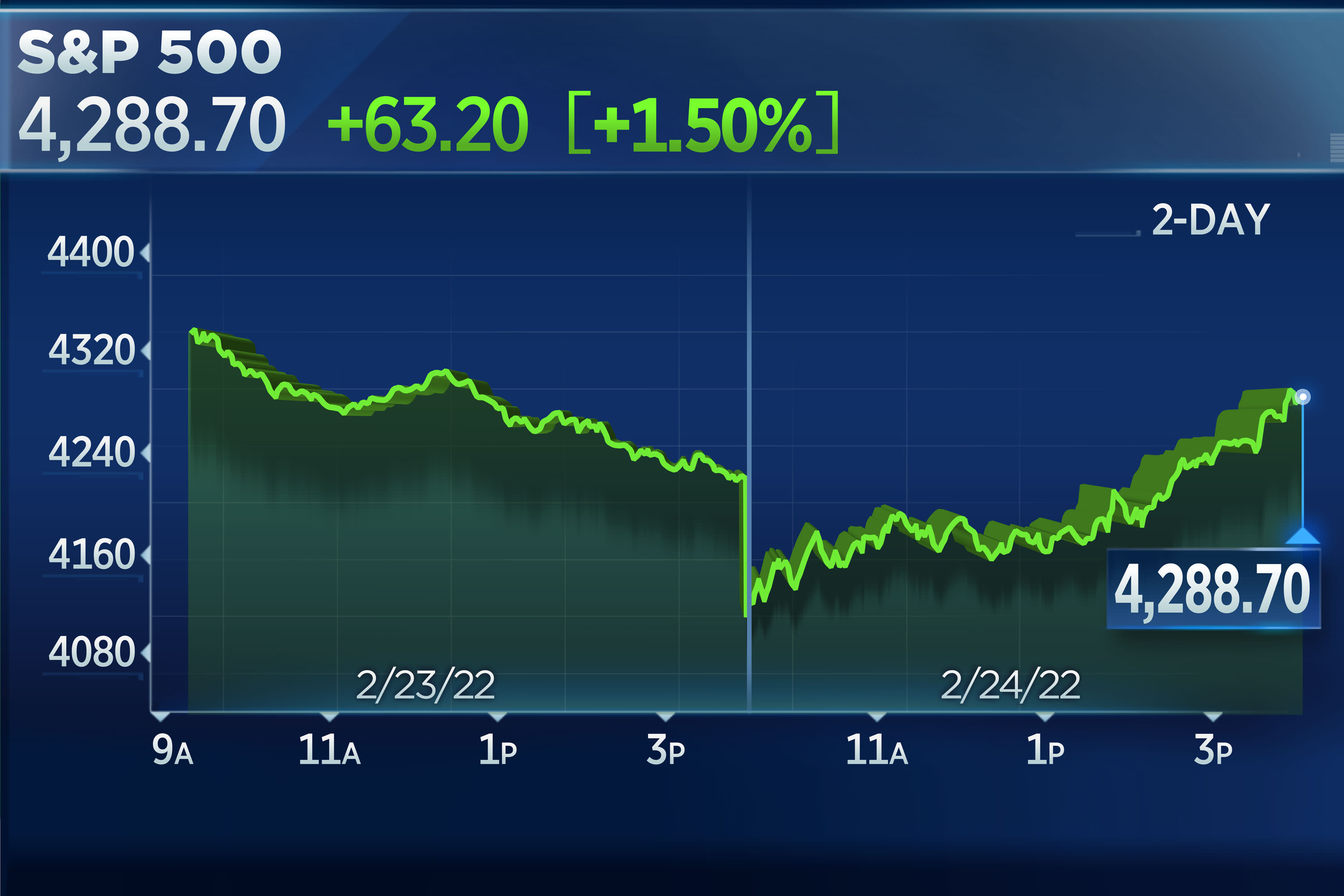

S P 500 Closes 1 5 Higher After Sharp Reversal As Traders Shake Off Russia S Invasion Of Ukraine

Owning U S Homes Pays Off As Equity Beats Mortgage Debt Mortgage Debt Mortgage Equity

/stocks_istock522868024-5bfc47b946e0fb002607e1ed.jpg)

Best Time S Of Day Week And Month To Trade Stocks

Are You Guilty Of These 3 Bad Investor Behaviors Investing Infographic Finance Investing Investing

Best Time S Of Day Week And Month To Trade Stocks

Nvda Stock Is Ready To Rally After The Recent Sharp Sell Off

Market Wrap Year End Review When Institutions Cashed Out Of Bitcoin Bitcoin Price Bitcoin Renewable Energy Resources

Psychology Of What Could Happen The Next 4 Year With The Market Stock Market Stock Market Data Marketing Data

Best Time S Of Day Week And Month To Trade Stocks

Little Bighorn Stock Market Investing In Stocks Stocks For Beginners

The Best Performing Stocks In The Last 10 Years Spendmenot

The Nifty Pse Index Of Public Sector Enterprises Ended A Second Wave At A 38 2 Retracement Wave 2 Ended And Https Www Indi Index Pse Stock Market Index

:max_bytes(150000):strip_icc()/dotdash_INV_final-52-Week-Range_Feb_2021-02-40c49fe9287645d5a2b8b0308b77fa5f.jpg)